Cancún, Quintana Roo — Vacation rentals in the Mexican Caribbean declined at the end of 2025 compared to the previous year, but industry officials expect a positive outlook for 2026, coupled with growth in inventory.

“By the end of 2025, the vacation rental market continues to consolidate as a strategic component within the tourism sector, still driven by the sustained growth in international tourist arrivals,” said Manuel Lozano, president of the Vacation Rental Administrators Association.

At the national level, he specified, the short-term rental segment remains dynamic, growing both in properties under development and in units being added to inventory, especially by tourists seeking experiences with locals.

Digital platforms, he emphasized, have democratized small owners’ access to the tourism market, allowing them to generate income and expanding the supply. This has also increased the number of real estate investors, including local personal investors, as well as national and foreign investors coming to the destination seeking these opportunities.

Cancún, Playa del Carmen, and Tulum represent the main tourist points with vacation rentals. Cancún alone generated a total of $686 million in that category in 2025, representing a reduction compared to 2024, when it was $747 million.

“There is a change of about eight percent, roughly to give you an idea. In 2024 there were over 14.1 million available nights, and in 2025 the figure was similar. This means the market for available nights was practically the same, but demand was lower,” he specified.

There was also a drop of almost 1 percent in rates ($153 average versus $154), which have been pressured to do so due to lower guest demand, coupled with many starting to regularize tax payments last year, added to service costs like property cleaning.

Specifically in Cancún, the market value is approximately $122 million, against $132 in 2024; available nights decreased from 2.8 to 2.7 million, and the rate from $118 to $116.

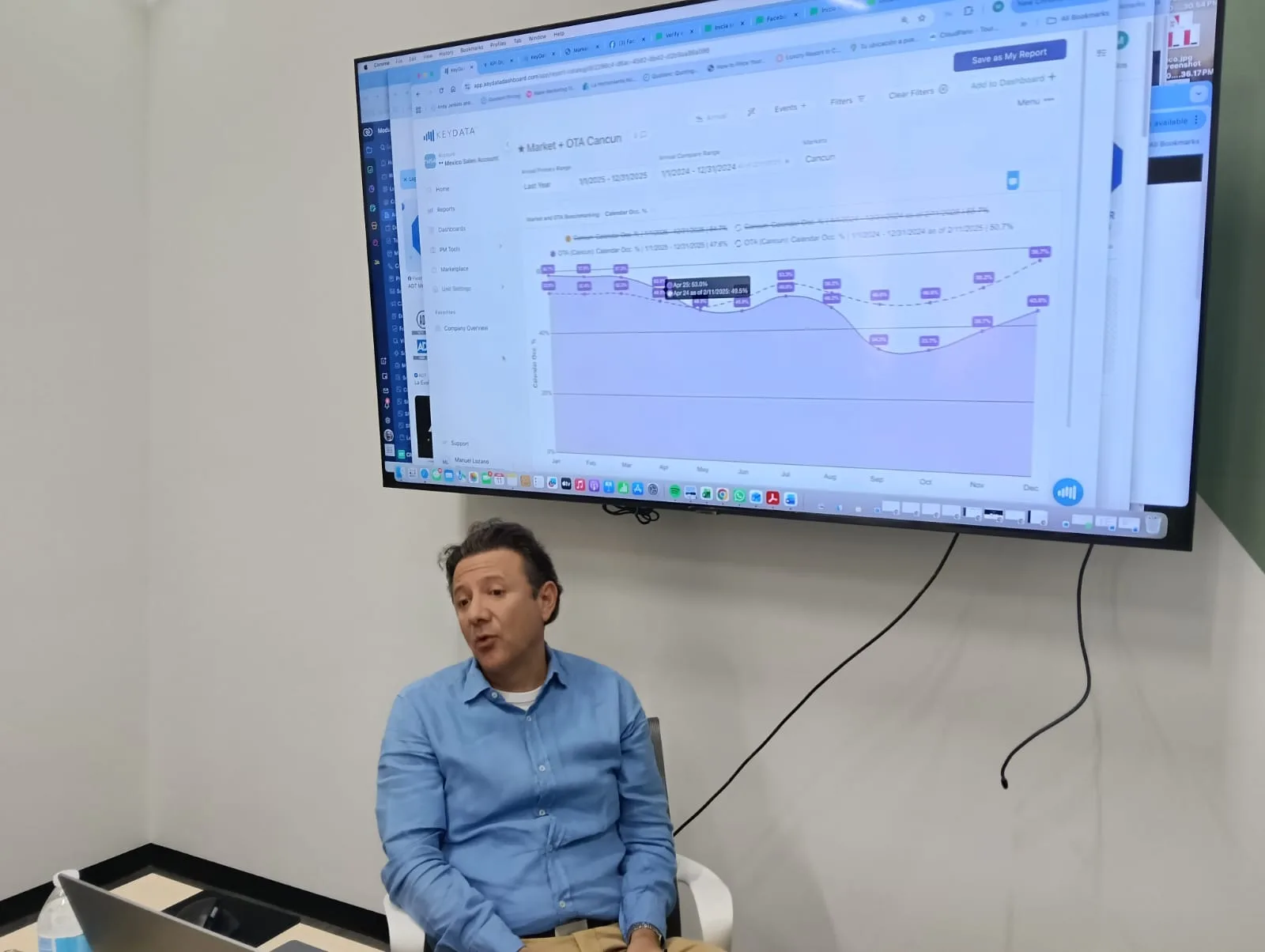

“We have a supply of about 17,000 active properties in the area, which has also generated an oversupply. The annual occupancy in 2024 was 49.5 percent and in 2025 it was 47.6 percent,” he detailed.

Despite these figures, he estimated an increase in demand for alternative lodging this year, which could benefit Quintana Roo, especially Cancún.

Discover more from Riviera Maya News & Events

Subscribe to get the latest posts sent to your email.